Why I Built a Bank Statement Tool for My Finance Team

Published On: May 15 2025

Written By: Krishnan Sethuraman

Category: Business Automation

Every week, I had to choose between two bad options: share my bank login with my team or waste time downloading and emailing statements. Neither felt right — so I built a better way.

TL;DR

1. Managing a single business bank account with multiple stakeholders created a constant tension between security (not sharing credentials) and efficiency (giving the finance team quick access). Manual workarounds like emailing CSVs led to version chaos, wasted time, and dependency bottlenecks.

2. To solve this, the author built a simple web application where bank statements (CSV uploads) can be centralized, searched, and shared securely—without logging into the bank portal. This tool eliminated spreadsheet mess, improved collaboration, and safeguarded sensitive access.

3. Though currently reliant on manual uploads, the vision is real-time, secure bank integrations. The broader lesson: small, focused tools can dramatically improve workflows, proving that security and efficiency don't have to conflict.

Running a business often feels like a balancing act between efficiency and security. On one side you want to delegate tasks so that you can steer the business to the next level. On the other hand you don't want to compromise the security of sensitive information.

In addition to dealing with sensitive information, the user interface of the bank statements that banking portals offer are borderline pathetic. They are not user friendly and also offer a lot of restrictions in terms of amount of data that can be accessed and downloaded at any given time.

As an entrepreneur I faced all these challenges and that's motivated me to build a tool where I can see statements of the bank accounts of my company without logging into the bank's web portal. My accountants (aka bookkeepers) can now easily view and manage the bank statements and use it for their day to day tasks.

This article isn't about technical details or coding. It's about a real business problem I had, and the practical solution that came out of it.

The Problem: Too Many People, One Bank Account

Like most small companies, we have a single corporate bank account where all our business transactions happen. Purchases, payments, salaries, customer receipts — everything flows through this one account.

Now, here’s the issue: multiple people need access to this account to their jobs. My partner who is in charge of making sure our payments from certain customers have come in. Also the accountants (aka bookkeepers) need to keep track of expenses and income and perform account reconciliation regularly.

But sharing the bank details with multiple people was very difficult and also not advisable from a security standpoint. Not that people are to be blamed but if confidential passwords circulate around the organization it will eventually leak to someone knowingly or unknowingly.

In addition to that the banking portals are not user friendly. Every time you had to perform some kind of reconciliation or analysis you had to download the statement in excel format. Once your work is done the spreadsheet is forgotten and rots on your hard disk.

So I found myself in a constant tug-of-war: either I personally logged in to fetch data every time someone needed it, or I gave too much access to people who shouldn’t really have it. Neither option was sustainable.

The First Idea: Manual Workarounds

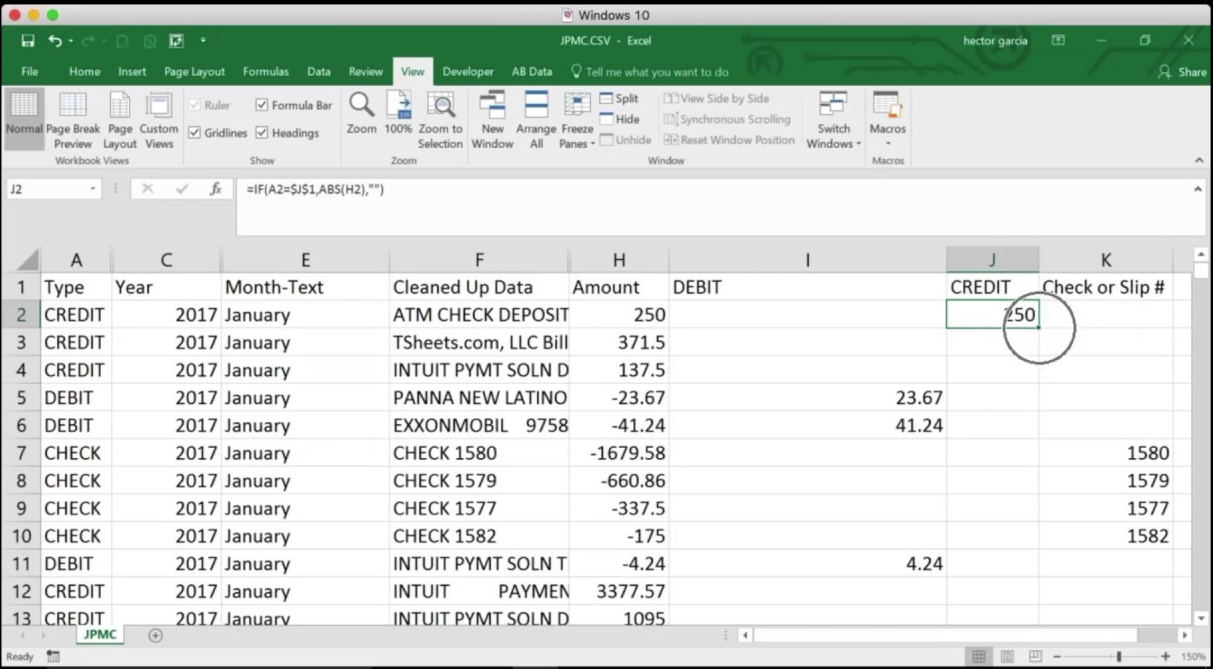

For a while, I resorted to the simplest workaround. Every month, I would download the bank statement in CSV format (a spreadsheet file that the bank provides) and share it with the finance team.

At first, it worked. The team had the data they needed, and my account credentials stayed safe. But soon, the cracks began to show:

- Version confusion: I’d share one file, someone else would make edits, and suddenly there were five versions of the same statement floating around. Nobody knew which one was the latest.

- Lost time: Team members had to dig through spreadsheets manually, apply filters, and perform calculations. It was slow, clunky, and error-prone.

- Dependence on me: I became the bottleneck. If I forgot to download and share the statement on time, their work got delayed.

- Lost spreadsheets: The finance team would do the analysis on a file and if the file gets lost or deleted we had to download the statement again to do our work.

The finance team wasn’t happy, and neither was I.

The Solution: A Simple Web Application

I googled to find if there is a simple tool that integrates with the company’s bank account and retrieves statements at regular intervals. To my surprise I did not find any. The only alternative was a full blown accounting software. But I was not looking for accounting or bookkeeping software. I was looking for a simple tool which allowed me to view the bank statements and share them without having to login into the bank’s web portal. I could not find any.

That’s when I decided to build it myself to address this nightmarish manual problem.

The idea was straightforward:

- I would download the CSV file from the bank (as usual).

- Instead of emailing it to everyone, I’d upload it into a secure web application.

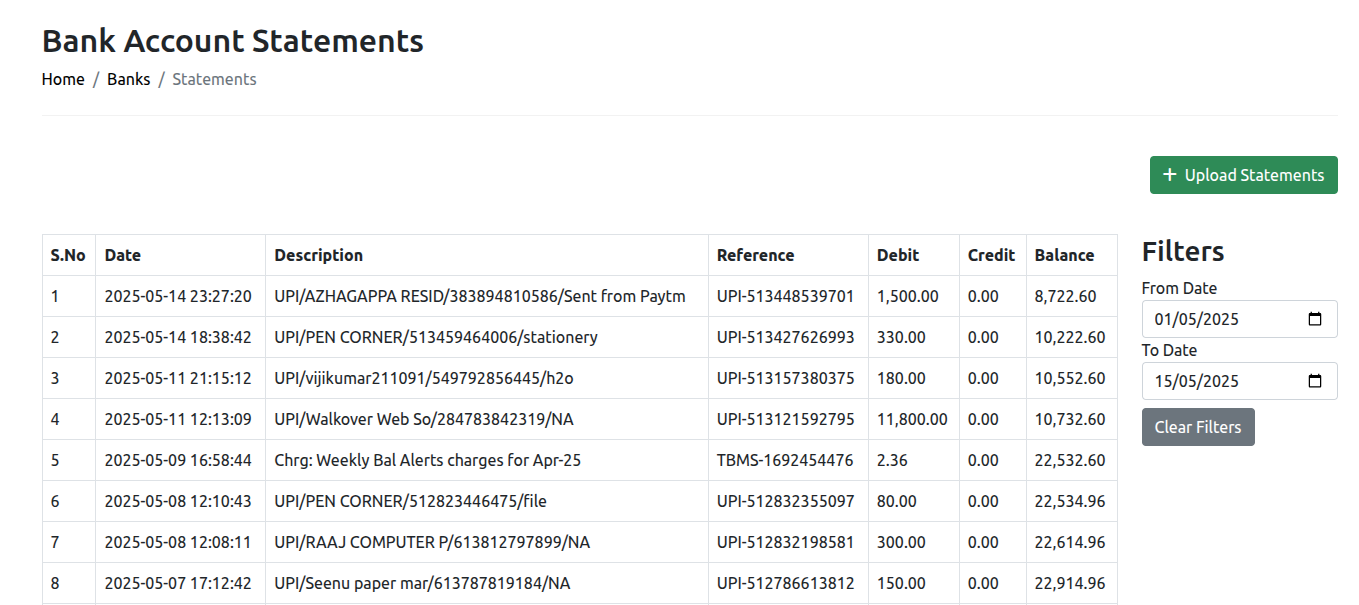

- The finance team could then log in to this tool, view the statements, apply filters, and view whatever reports they needed.

No one needed to touch the actual bank account. No one needed to worry about conflicting files or mismatched versions. Everything would live in one place, always updated, always accessible.

How It Works in Practice

Here's how we use it in our company today:

- Weekly routine: Once a week, I download the bank statement file from the bank portal in csv format. While downloading make sure the debit and credit are in different columns. It takes less than a minute.

- Sanitize spreadsheet: My bank adds unwanted information in the csv file. This is nonsense but that’s how it is. So I take a minute to remove them. This totally depends on csv or excel file that your bank provides.

- Upload: I log in to the bank statement tool and upload the file. Done.

- Access for the team: Instantly, the statement becomes available for the whole finance team inside the application. They can search, filter, and view transactions without touching the bank portal.

The tool has various user roles so you can make someone admin and others regular users.

It’s that simple. The process that used to feel like a chore has now become part of our regular workflow.

Limitation

For now the statement needs to be uploaded manually in csv format. We are working with banks to integrate this tool with them so that the statements appear almost in real time without any human intervention.

Why It Matters

The impact of this simple little tool turned out to be bigger than I expected. Here's why:

Bank Account Security

I no longer need to share bank credentials with anyone. My account remains secure, with access restricted only to me and my co-foudner. At the same time, my team isn't slowed down because they can still see all the data they need.

Efficiency for Accountants

Accountants live and breathe numbers, but they shouldn't have to waste time fighting with messy spreadsheets. In the tool, we've built intuitive filters and download options. Need to see only last month's transactions? Two clicks. Want to filter by transaction type? Type their name and you're done.

One Source of Truth

Everyone in the team is now looking at the same version of the data. There are no duplicate spreadsheets, no email chains with attachments, no "Oops, I was looking at last week’s file." kind of scenario.

Scalability

As our company grows, the number of people needing access to financial data will grow too. This tool scales beautifully. I can add new team members without ever worrying about giving away sensitive login information or dealing with horrible UX of the bank's web portal.

Looking Ahead

Right now, the tool works with manual uploads. I still have to download the CSV file once a week and upload it into the system. That’s fine for now, especially since it only takes a minute.

But the long-term vision is even more exciting. Eventually, this tool will connect directly with the bank account (through secure integrations). That means the statements will update in real time. The finance team won’t even have to wait for me to upload anything.

Until then, the MVP (minimum viable product) we have today is already a game-changer for us.

Lessons Learned

Looking back, there are a few lessons from this journey that might resonate with other business owners:

Sometimes the problem isn’t technical - it’s workflow. For us, the bottleneck wasn’t about not having the data. It was about how the data was being shared.

Small tools can make a big impact. This isn’t a massive software project, but it solved a major pain point for our team.

Security and efficiency can coexist. Often, it feels like you have to choose between protecting sensitive information and giving people access. With the right system, you can have both.

Start small, then grow. We didn't wait to build a fully automated, bank-integrated tool. We started with something simple that worked — and that was enough to change our workflow immediately.

Final Thoughts

Running a business is full of trade-offs. You're constantly balancing security, speed, accuracy, and trust. For me, building this tool was about finding the balance in one small but important area: giving my finance team the access they need in a secure and efficient way.

Today, our accountants work faster and with fewer mistakes. I sleep better knowing our bank account is secure. And our company has one less recurring headache to worry about.

Sometimes, the best solutions are the simplest ones.

If this sounds useful for your business, we've made the tool publicly available here. It’s free to try.

Krishnan Sethuraman

Founder & CTO of Geedesk. Passionate about building software from scratch, launching SaaS products, and helping teams deliver enterprise-grade solutions.

Like what you are reading?

Discover more similar articles sent to your email

Subscribe to my newsletter